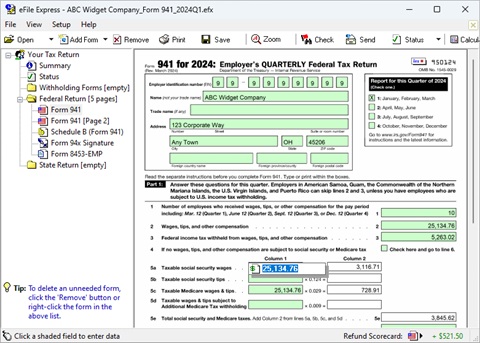

E-file 2025-2023 IRS Quarterly Form 941 and Annual Form 94x Returns

Employers, business owners and their agents can quickly and securely e-file their quarterly Form 941 returns (and their annual Form 940, Form 943, Form 944 or Form 945 return) using eFile Express.

Filing is low-cost and easy to do!

First-time users can file in 4 easy steps:

1. Download and install the eFile Express software on your Windows PC (click here to open the Download page).

2. Download the FormPak that includes the forms you need to file (click here for a list of available Form 94x-series FormPaks).

3. Once installed, start the eFile Express software, click the "Add Form" button to open your downloaded-FormPak and enter your data directly into the on-screen forms.

4. When you're ready to file, click the "Send" button in the software to encrypt your return and electronically send it for processing. We'll keep you updated on the status of your return via email.

Note that with eFile Express, your data remains on your PC until you're ready to file. And once your return is "accepted", you can quickly print your return or generate a PDF for your records.

Note that for most businesses, filing a Form 94x-series return costs just $8. We also offer low-cost e-filing for Reporting Agents who file Schedule R's listing multiple clients. Visit our Pricing page for more information.

2025-2023 IRS Form 94x-series* FormPaks™ for Employers

* Form 940, Form 941, Form 943, Form 944 and Form 945

Click on a link below to download IRS FormPaks for preparing and e-filing employer federal payroll returns.

|

|

|

|

|

|

|

Need help? Click...

Need help? Click...

Use these FormPaks if you are a business owner or an employee or a representative of the business. If you are a professional tax preparer, use the TaxPro FormPaks at the bottom of this page.

2025 Returns- Form 941 FormPak* (for

2025 returns)

- used by all quarterly filers

- Form 940 FormPak* (for

2025 returns)

- Form 943 FormPak* (for

2025 returns)

- Form 944 FormPak* (for

2025 returns)

- Form 945 FormPak* (for

2025 returns)

- Form 941 FormPak* (for

2024 returns)

- used by all quarterly filers

- Form 940 FormPak* (for

2024 returns)

- Form 943 FormPak* (for

2024 returns)

- Form 944 FormPak* (for

2024 returns)

- Form 945 FormPak* (for

2024 returns)

- Form 940 FormPak* (for

2023 returns)

- Form 943 FormPak* (for

2023 returns)

- Form 944 FormPak* (for

2023 returns)

- Form 945 FormPak* (for

2023 returns)

- Form 941-X FormPak (for 2025 and

2024 returns)

- used by all quarterly filers

- Form 940 (use Form 940 FormPak)

- Form 943-X FormPak

- Form 944-X FormPak

- Form 945-X FormPak

|

|

Form 941 FormPak includes Schedule B, Schedule R, Form 8974 |

|

|

Form 940 FormPak includes Schedule A, Schedule R, Form 8974 |

|

|

Form 943 FormPak includes Form 943-A, Form 8974 |

|

|

Form 944 FormPak includes Form 945-A, Form 8974 |

|

|

Form 945 FormPak includes Form 945-A |

Use this FormPak to request a signature PIN for signing the business' 94x-series returns. (Note that while PIN requests are usually processed within 24 hours, it can take the IRS up to 45 days to mail the PIN to the corporate officer or authorized employee.)

Use these FormPaks if you are a professional tax preparer and have set up an eFile Express TaxPro account.

2025 Returns for TaxPros- Form 941 TaxPro FormPak* (for

2025 returns)

- used by all quarterly filers

- Form 940 TaxPro FormPak* (for

2025 returns)

- Form 943 TaxPro FormPak* (for

2025 returns)

- Form 944 TaxPro FormPak* (for

2025 returns)

- Form 945 TaxPro FormPak* (for

2025 returns)

- Form 941 TaxPro FormPak* (for

2024 returns)

- used by all quarterly filers

- Form 940 TaxPro FormPak* (for

2024 returns)

- Form 943 TaxPro FormPak* (for

2024 returns)

- Form 944 TaxPro FormPak* (for

2024 returns)

- Form 945 TaxPro FormPak* (for

2024 returns)

- Form 940 TaxPro FormPak* (for

2023 returns)

- Form 943 TaxPro FormPak* (for

2023 returns)

- Form 944 TaxPro FormPak* (for

2023 returns)

- Form 945 TaxPro FormPak* (for

2023 returns)

-

Form 941-X TaxPro FormPak (for 2025 and

2024 returns)

- used by all quarterly filers

- Form 940 (use Form 940 TaxPro FormPak)

- Form 943-X TaxPro FormPak

- Form 944-X TaxPro FormPak

- Form 945-X TaxPro FormPak

|

|

Form 941 TaxPro FormPak includes Schedule B, Schedule R, Form 8974 |

|

|

Form 940 TaxPro FormPak includes Schedule A, Schedule R |

|

|

Form 943 TaxPro FormPak includes Form 943-A, Form 8974 |

|

|

Form 944 TaxPro FormPak includes Form 945-A, Form 8974 |

|

|

Form 945 TaxPro FormPak includes Form 945-A |